Bcg Matrix On Icici

ICICI's shareholding in ICICI Bank was reduced to 46% through a public offering of shares in India in fiscal 1998, an equity offering in the form of ADRs listed on the NYSE in fiscal 2000, ICICI Bank's acquisition of Bank of Madura Limited in an all- stock amalgamation in fiscal 2001, and secondary market sales by ICICI to institutional. OF STRATEGIC MANAGEMENT ON “BCG MATRIX OF COCO-COLA”. SUBMITTED TO, SUBMITTED BY.

Market Activated Corporate Strategy (MACS) Framework

MACS (Market Activated Corporate Strategy) framework represents much of McKinsey’s most recent thinking in strategy and finance, it is a framework that offers a systematic approach for the multi-business corporation to prioritize its investments among its business units.How should a corporation decide whether to buy, sell, or keep a business unit? In the late 1980s, McKinsey developed its market activated corporate strategy (MACS) framework, which answered that question in a surprising way. The obvious considerations – the attractiveness of the industry in which the unit competes and its competitiveness within that industry – are both relevant, but the acid test is which company can extract the greatest value from the business. If the present owner should be that company, it probably ought to keep even a mediocre or poorly performing unit. A company should make sure that it is the best possible owner of each of its business units – not simply hold on to units that are strong in themselves.The key insight of MACS is that a corporation’s ability to extract value from a business unit relative to other potential owners should determine whether the corporation ought to hold onto the unit in question.In the MACS matrix, the axes from the old nine-box framework measuring the industry’s attractiveness and the business unit’s ability to compete have been collapsed into a single horizontal axis, representing a business unit’s potential for creating value as a stand-alone enterprise. The vertical axis in MACS represents a parent company’s ability, relative to other potential owners, to extract value from a business unit. And it is this second measure that makes MACS unique.Managers can use MACS just as they used the nine-box tool, by representing each business unit as a bubble whose radius is proportional to the sales, the funds employed, or the value added by that unit. The resulting chart can be used to plan acquisitions or divestitures and to identify the sorts of institutional skill-building efforts that the parent corporation should be engaged in. There are several qualification for the company that can highlight its ability to the the owner of the business:

There are several qualification for the company that can highlight its ability to the the owner of the business:Related Articles:

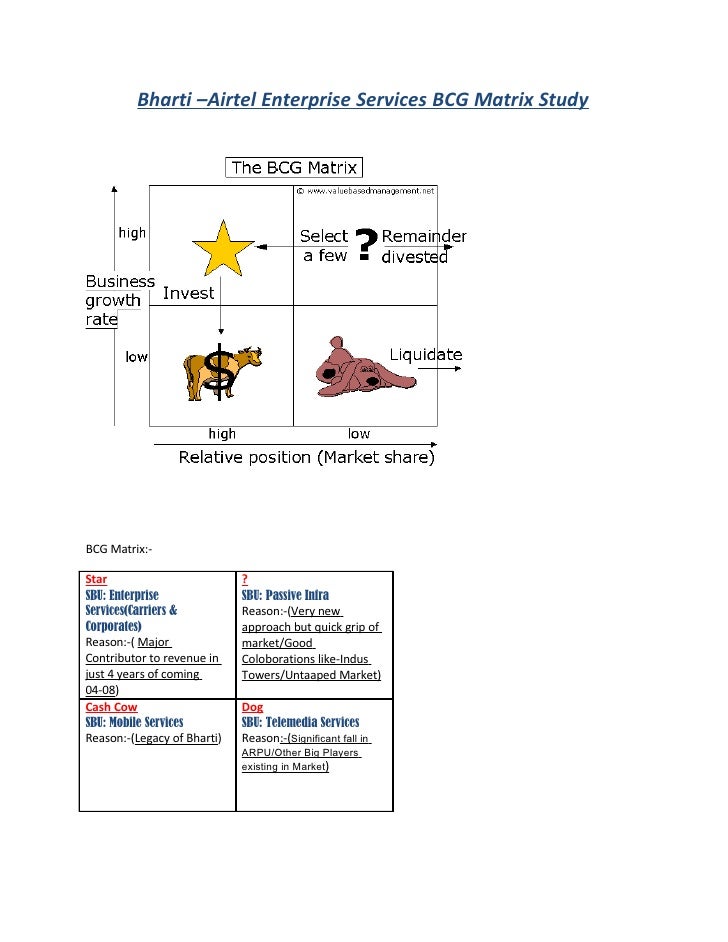

Bcg Matrix Of Icici Bank Frfee. What is BCG matrix?The BCG matrix is a chart that had been created by Bruce Henderson for the Boston Consulting Group in 1968 to help corporations with analyzing their business units or product lines. This helps the company allocate resources and is used as an analytical tool in brand marketing, product management, strategic management, and portfolio analysis.

.Corporation of India Limited. In 1995, it was incorporated as the initiative of World Bank. Objective: Creating a development financial institution for providing medium term and long term projects financing to Indian Business.

In 1994, ICICI established Banking Corporation as a Banking Subsidiary which was later renamed as “ICICI Bank Limited”. 2. In the 1990s, ICICItransformed its business from In October 2001, the BoD of a development financial In 1999, ICICI become ICICI and ICICI Bank institution offering only the first Indian company approved the merger of project finance to a ICICI and two of its wholly- and the first bank or diversified financial services owned retail finance group offering a wide variety financial institution subsidiaries, ICICI Personal of products and from non-Japan Asia to Financial Services Limited services, both directly and be listed on the NYSE. And ICICI Capital Services through a number of Limited, with ICICI Bank. Subsidiaries.

By the High Court of Judicature at Mumbai and the Reserve Bank of India in April 2002.By the High Court of Gujarat at Ahmedabad in March 2002.by shareholders of ICICI and ICICI Bank in January 2002.3. The merger was approved:. 4. ‘s Subsidiaries.

5. ICICI Bank is Indias second-largest bank. The Bank has a network of 2,888 branches and 10,021 ATMsin India, and has a presence in 19 countries, including India. Equity Shares listed in BSE, NSE. Its American Depositary Receipts (ADRs) are.Words: 1839 - Pages: 8.OF SBI AND ICICI BANKDR. PRIYANKA TANDON.

Associate Professor LDC Institute of Technical Studies Soraon, Allahabad (Uttar Pradesh) India. Assistant Professor LDC Institute of Technical Studies Soraon, Allahabad India ABSTRACT Banking Sector plays an important role in economic development of a country. The banking system of India is featured by a large network of bank branches, serving many kinds of financial services of the people. The State Bank of India, popularly known as SBI is one of the leading bank of public sector in India. SBI has 14 Local Head Offices and 57 Zonal Offices located at important cities throughout the country.

ICICI Bank is second largest and leading bank of private sector in India. The Bank has 2,533 branches and 6,800 ATMs in India. The purpose of the study is to examine the financial performance of SBI and ICICI Bank, public sector and private sector respectively. The research is descriptive and analytical in nature.

The data used for the study was entirely secondary in nature. The present study is conducted to compare the financial performance of SBI and ICICI Bank on the basis of ratios such as credit deposit, net profit margin etc. The period of study taken is from the year 2007-08 to 2011-12. The study found that SBI is performing well and financially sound than ICICI Bank but in context of deposits and expenditure ICICI bank.Words: 5028 - Pages: 21.BCG Matrix, SWOT Analysis and Porter ModelBCG MatrixIntroduction:The Boston Consulting Group (BCG) Matrix is an uncomplicated tool to evaluate a company’s position in terms of its product range.

It facilitates a company think about its products and services and makes decisions about which it should keep, which it should let go and which it should invest in further. Also called the BCG Matrix, it provides a useful way of screening the opportunities open to the company and helps to think about where one can best allocate resources to maximize profit in the future. At the end of the 1960s, Bruce Henderson, creator of the Boston Consulting Group, BCG, developed portfolio matrix. The BCG Growth-Share Matrix is a fourcell (2 by 2) matrix used to execute business portfolio analysis as a footstep in the strategic planning process. BCG matrix is often used to prioritize which products within company product mix get more funding and attention BCG matrix takes into account two strategic parameter into consideration namely, market share and market growth. To understand the Boston Matrix, one must understand how market share and market growth are interrelated. Market share is the percentage of the total market that is being serviced by a company under consideration, measured either in revenue terms or unit volume terms.

Higher the market share, the higher the proportion of the market one controls. The Boston Matrix assumes that if the company under consideration is enjoying a high.Words: 2976 - Pages: 12.ASSIGNMENT - 1ONICICI BANKInBANKING SECTORbyName:- PUNEET RATHIDivision:- CRoll No.:- 243MBA-CORE (I year)picCONTENTSPage No. Introduction to Banking Sector 3. Activities of a Bank 4.

Banking Sector in India 5. Regulations 6. ICICI Bank 8o Services Offered 9o Financial Indicators 11o Corporate Social Responsibility 12o Partners 13o PFFF 14o SWOT analysis 15o ICICI vs. HDFC bank 16. References 21Introduction to Banking SectorBanking is defined as the business of the bank or the occupation of a banker.A bank is a financial intermediary that accepts deposits and channels those deposits into lending activities. Banks are a fundamental component of the financial system, and are also active players in financial markets. The essential role of a bank is to connect those who have capital (such as investors or depositors), with those who seek capital (such as individuals wanting a loan, or businesses wanting to grow).Banking is generally a highly regulated industry, and government restrictions on financial activities by banks have varied over time and location.The standard activities of a Bank.Words: 7009 - Pages: 29.SWOT Analysis on XEROXJOYCE D.

DERRYMGT/521FEBRUARY 13, 2014UNIVERSITY OF PHOENIXSWOT Analysis on XEROXXerox CorporationXerox Corporation was found in 1906 as the Haloid Company in Rochester, New York. The Haloid Company was involved in manufacturing photographic paper and equipment. In 1961, its name was changed to Xerox Corporation.

The first xerographic image was created by Chester Carlson (October 22, 1938), a patent attorney & part time inventor in his lab in Astoria, Queens, in New York City. Initially, his invention could not get success. In 1944, Carlson received patent for electrophotography, which was later called xerography.1947 was the year when The Haloid Company acquired the license for using the invention of Carlson in its copying machine from Battelle Development Corp. Of Columbus, Ohio. After some time, Haloid received full rights of Carlson's invention for using it in its copying machines. In 1948, Haloid get the word 'Xerox' trademarked.

After the initial success, Haloid changed its name to Haloid Xerox Inc. In 1958, and later it was changed to Xerox Inc. In 1961 (Online Fact Book, 2009).BusinessXerox Corporation is involved in manufacturing, supplying and servicing a number of document equipment, services and software solutions. Today, Xerox Corporation is supplying a variety of digital systems such as printing (color & black/white) & publishing systems, fax machines, digital presses, solid & laser ink printers.Words: 1911 - Pages: 8.SWOT Analysis TemplateStrengthsPossible StrengthsTangible Strengths Consider your assets including plant and equipment Do you have long-term rental contracts for your business locations? Are your products unique or market leading? Have you got sufficient financial resources to fund any changes you would like to make? Do you have any cost advantages over your competitors?

Do you use superior technology in your business? Is your business high volume? Can your scale up your volume if you need to?

Jun 10, 2019 Free Mp3 Dio Dio Audio Song Download Download, Lyric Dio Dio Audio Song Download Chord Guitar, Free Ringtone Dio Dio Audio Song Download Download, and Get Dio Dio Audio Song Download Hiqh Qualtiy audio from Amazon, Spotify, Deezer, Itunes, Google Play, Youtube, Soundcloud and More. Jun 06, 2019 Free Mp3 Dio Dio Disaka Mp3 Song Download Download, Lyric Dio Dio Disaka Mp3 Song Download Chord Guitar, Free Ringtone Dio Dio Disaka Mp3 Song Download Download, and Get Dio Dio Disaka Mp3 Song Download Hiqh Qualtiy audio from Amazon, Spotify, Deezer, Itunes, Google Play, Youtube, Soundcloud and More. Create a custom radio station from your favorite songs by Dio on iHeartRadio. Listen to music you'll love! Create a custom radio station from your favorite songs by Dio on iHeartRadio. Music, radio and podcasts, all free. Listen online or download the iHeartRadio App. Artist Radio. Dio dio song download. Music Downloads. Search and download from over 6 million songs, music videos and lyrics. Largest collection of free music. All songs are in the MP3 format and can be played on any computer or on any MP3 Player including the iPhone.

Intangible Strengths Do you have or stock strong recognisable brands Your reputation - are you considered a market leader? Or an expert in your filed? Do you have good relationship with your customers?

Bcg Matrix On Icici Stock

(Goodwill) Do you have strong relationships with your suppliers Do you have a positive relationship with your employees Do you have any unique alliances with other businesses? Do you own any patents or proprietary technology? Do you have a proven advertising process that works well? Do you have more experience in your field?

Are you managers highly experienced? Whatmakesagoodleader.com Page 1 of 5ResponseIs it a strength?SWOT Analysis TemplateStrengthsPossible Strengthsexperienced? Do you have superior industry knowledge? Are you involved with industry associations? Is your business Innovative? Other Strengths SpecifyResponseIs it a strength?whatmakesagoodleader.com Page 2 of 5SWOT Analysis TemplateWeaknessesPossible WeaknessesTangible.Words: 615 - Pages: 3.Act of Parliament, viz.

Click to expand.Haha, yeah I have to admit I've never tried it, but I figured that since there are so many guides on getting it running and (relatively)so many people talking about it, that there had to be decent compatibility. How to install fmcb on a modded ps2.

LIC Act, 1956, with aCapital contribution of Rs. 5 crore from the government of India.COMPLETE PROFILEOverviewICICI Prudential Life Insurance Company is a joint venture between ICICI Bank - one of India's foremost financial services companies-and prudential plc - a leading international financial services group headquartered in the United Kingdom. Total capital infusion stands at Rs. 29.32 billion, with ICICI Bank holding a stake of 74% and Prudential plc holding 26%.We began our operations in December 2000 after receiving approval from Insurance Regulatory Development Authority (IRDA). Today, our nation-wide team comprises of over 735 offices, over 243,000 advisors; and 22 banc assurance partners.ICICI Prudential was the first life insurer in India to receive a National Insurer Financial Strength rating of AAA (Ind) from Fitch ratings.

For three years in a row, ICICI Prudential has been voted as India's Most Trusted Private Life Insurer, by The Economic Times - AC Nielsen ORG Marg survey of 'Most Trusted Brands'. As we grow our distribution, product range and customer base, we continue to tirelessly uphold our commitment to deliver world-class financial solutions to customers all over India.The ICICI Prudential EdgeThe ICICI Prudential edge comes from our commitment to our customers, in all that we do - be it product development, distribution d sales process or servicing. Here's a peek into what.Words: 6854 - Pages: 28.Roger’s Chocolates SWOTII.

SWOT Analysis.Employee Interest and Devotion to Company◦Some of Rogers Chocolate Employees were third generationemployees and were proud and passionate about Rogersheritage and commitment to quality. They believed in the Brandand its image.Leadership with Experience◦Parkhill who had previously worked as the VP for Maple LeafFoods was in charge of six plants and 2,300 employees. Has aIvy League MBA and has extensive work in Sales, Marketing andOperations.Progressive Management Team◦Management consists of members who will work extra hours andare very efficient in their respective fields. Phoenix has had atenure since 1994 and is very dedicated to Rogers by workingextra hours and helping out at stores that are short of staff.Wong works with manufacturing and Food Science and hadworked in the industry before Rogers. Bjornson worked withPacific Coach Lines as the CFO and worked their financesespecially in the areas of reorganization, acquisitions anddispositions.3. Consumer Loyalty.Customers are loyal to Rogers because they have an emotionalconnection that relates them to Rogers.

This revolves around theII. SWOT Analysisexperience that Rogers tries to promote, especially in their gift line.4.

Social Awareness.Part of the workforce at Rogers is comprised of disabled individualswho help out in production.5. Revenues and Margins.Words: 638 - Pages: 3.International Journal of Recent Research in Social Sciences and Humanities (IJRRSSH)Vol.

1, Issue 1, pp: (29-39), Month: April - June 2014, Available at: www.paperpublications.orgAn Analysis of Indian Banking Industry withSpecial Reference to ICICI BankSana SamreenAbstract: The last decade has seen many positive developments in the Indian banking sector. The policy makers, whichcomprise the Reserve Bank of India (RBI), Ministry of Finance and related government and financial sectorregulatory entities, have made several notable efforts to improve regulation in the sector. The sector now comparesfavorably with banking sectors in the region on metrics like growth, profitability and non-performing assets (NPAs).However, improved regulations, innovation, growth and value creation in the sector remains limited to a small part ofit. The cost of banking intermediation in India is higher and bank penetration is far lower than in other markets.India’s banking industry needs to strengthen itself significantly In this paper, I have mainly focused on the overallanalysis of the banking industry through framework like Porter’s five forces model.

I have also concentrated upon thevarious developments being done in the industry along with recognizing the upcoming challenges as well as theopportunities to reap the profits even in troubled waters.Keywords: Indian banking industry, Porters five force model, market regulation.I.IntroductionThe Indian.Words: 5454 - Pages: 22.“SWOT analysis is a planning exercise in which managers identify internal organizational strengths(S) and weaknesses(W) and external environmental opportunities(O) and threats(T)” (Jones/George, 2011). SWOTSWOT identifies and analyzes a company’s strengths and weaknesses. Conant wanted to the company to make a turnaround. Campbell company sales plummet by 30% during the early 2000’s. Conant incited a SWOT planning exercise that helps identify where Campbell needed to change to help the company keep up with what the public wanted. The public wanted healthier foods and sports drinks. Conant internal analysis identified a number of in major weakness (Jones/George, 2011).

The staff level was high, and the machinery used to make soup needed to be updated.Conant increased his profit by coming up with a three –year plan based on the SWOT analysis. He realized that the customers wanted a healthier appealing soup. He introduced more variety of soups which contend less sodium and low of salt. Conant made a decision that was very bold.

Godiva chocolates were a good fit but he questioned its profitability. He decided it was a weakness to the company so he sold it for $850 billion dollars. Conant decided it was time to make Campbell brands global. “Campbell shares have increased in the last 5 years and posted an 11% return” (Jones/George, 2011).Conant used the low cost strategy because he wanted to gain a completive advantage by cutting the cost down.Words: 403 - Pages: 2.

Thread / PostTagsTitle: Learning a Propagable Graph for Semisupervised Learning Classification and RegressiPage Link: -Posted By:Created at: Saturday 15th of April 2017 03:34:07 PM,Abstract In this paper, we present a novel framework, called learning by propagability, for two essential data mining tasks, i.e., classification and regression. The whole learning process is driven by the philosophy that the data labels and the optimal feature representation jointly constitute a harmonic system, where the data labels are invariant with respect to the propagation on the similarity graph constructed based on the optimal feature representation. Based on this philosophy, a unified framework of learning by propagability is propose.etcTitle: icici e learning matrix answersPage Link: -Posted By:Created at: Wednesday 10th of October 2018 02:56:26 PM,Hi i would like to get details on icici e learning matrix answers.My friend said icici e learning matrix answers will be available here.i need help.etcTitle: icici bank learning matrix answersPage Link: -Posted By:Created at: Saturday 15th of April 2017 11:05:03 PM,please reply me sir, am satishnd my email id is could you describe information on icici bank learning matrix answers. Sir my cousin abdul-jabaar said icici bank learning matrix answers will get here, make a answer on icici bank learning matrix answers.etcTitle: Development of a game to support the learning of phonics in early learningPage Link: -Posted By:Created at: Saturday 15th of April 2017 08:25:05 PM,Development of a game to support the learning of phonics in early learning.Some software engineering and enterprise programming projects ideasHere are some of my ideas about what might be interesting projects areas. None of these are fully worked out ideas - any student wanting to work with one of these will need to bring their own thoughts and ideas to it. All will require the development of some software - i.e. None are pure dissertation style projects.

Many are Comparison type projects. Th.etcTitle: icici learning matrix e learning answer keysPage Link: -Posted By:Created at: Sunday 16th of April 2017 02:17:01 AM,me karun can anyone please lit some data regarding icici learning matrix e learning answer keys. Class informer abid said icici learning matrix e learning answer keys may be available here or somebody will help me, reply us an answer about icici learning matrix e learning answer keys.etcTitle: Boston matrix BCG matrixPage Link: -Posted By:Created at: Saturday 15th of April 2017 11:15:08 PM,Boston matrix (BCG matrix)At the end of the 1960s, Bruce Henderson, founder of the BostonConsulting Group, BCG, developed his portfolio matrix.